It’s been the talk of the EdSurge office since March: After the blistering pace of VC investment in edtech over the first 3 months of 2014, how much would the industry rake in during Q2?

As June winds down, we’re getting our look at the answer. The edtech industry received just under $327 million dollars in VC investment in the second quarter of 2014, according to our preliminary analysis of deals reported in EdSurge and those logged in CrunchBase.

The single largest deal between April and June was the $80 million investment in Social Finance, Inc. (SoFi) in April; SoFi is a peer-to-peer lending organization that helps students refinance school loans, among other activities.

Leaving aside the SoFi deal, which is so large it skews the rest of the data set, here’s our quick breakdown of the numbers:

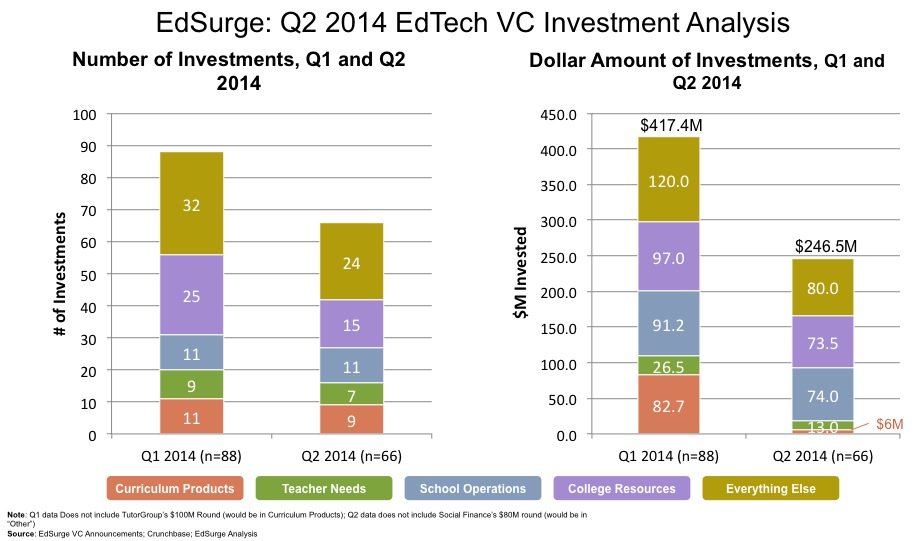

While the 66 deals reported are relatively evenly spread across our four defined categories in the left graph, the right graph shows that School Operations and College Resources dominated the dollar value of investments. Declara’s $25 million in funding this quarter, combined with Everspring’s and Schoology’s rounds, make up a sizable bulk of the School Operations segment; Udemy’s $32 million series C investment led the College Resources sector.

So it appears that the edtech industry has cooled a bit from the over $500 million in investment reported in Q1. Here is the comparison between Q1 and Q2, based on our data:

The total number of deals fell from 88 in Q1 to 66 in Q2. Although the number of deals for Curriculum Products was relatively stable (11 in Q1 vs 9 in Q2), the total dollar amount flatlined, from nearly $83 million in Q1 to just $6M in Q2. The top-funded companies in this category in Q2 included ThinkCERCA, Hopscotch, and Estonia-based language learning software, Lingvist.

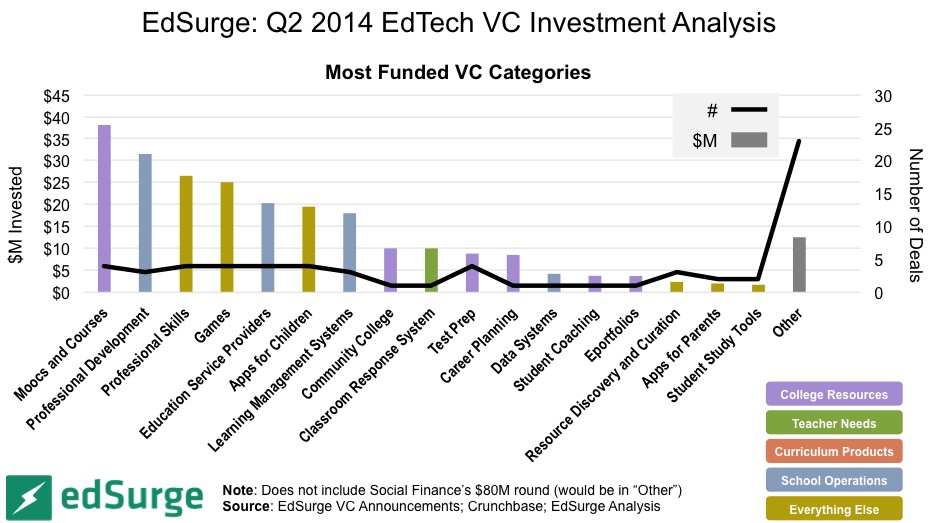

When we broke down these broad sectors into the more specific categories from our EdTech Index, we saw that MOOCs were the big winners (driven by Udemy’s funding), along with professional training and companies providing services to schools and districts.

What do you think? Why has edtech investment slowed in Q2? What further analysis would you like to see from EdSurge? Let us know on Twitter (@edsurge) or in the comments section below (but please keep in mind, Nate Silver doesn’t work here…)

Look out for an update to this data after Q2 officially ends on Monday. And as always, you can learn more about emerging products and companies on our EdTech Index.

NOTE: Individual deals with undisclosed funding totals were included in the count of number of deals, but are not counted in the total edtech dollar amount.

Editor's note: This article has been updated on Jun 1 to reflect final Q2'14 financing numbers. Report includes select major international & grant funding deals.