John Doerr is wary of unicorns these days. But he can’t help but love a company that is building technology that seems to make tiny elephants appear out of thin air.

Doerr, a long-time partner at Kleiner Perkins Caufield & Byers, has been a cornerstone of venture capital for decades, funding the likes of Google, Amazon and Twitter. He’s also played a pivotal role in education both by co-founding NewSchools Venture Fund and increasingly through investments.

A week ago, Doerr spoke to a small gathering of edtech entrepreneurs, hosted by Silicon Valley Bank and Reach Capital. He praised the investments that KPCB has already made in education: Chegg, Coursera, Duolingo, Newsela and Remind, as well as the edtech organizations he’s personally invested in, namely, Alt School, DreamBox and Khan Academy. He hinted at the firm’s latest investment. “It’s an exciting time to be an edtech company,” he said.

Even so, he cautioned that the funding world has gotten a bit carried away: “I’m concerned about the obsession with unicorns,” Doerr said, referring to billion-dollar-valued companies. “I don’t think that being a unicorn is really a great thing for most companies.”

Although the availability of capital and low startup costs make this a great time to be an entrepreneur, Doerr pointed out that building a huge company requires “tremendous” capital to get established.

Most traditional venture capitalists won’t see edtech as a unicorn-type of moneymaking opportunity, Doerr noted. “Edtech companies will attract edtech investors—but not general purpose investors.” On the other hand, edtech entrepreneurs “shouldn't want just any VC. Interview your venture backers—the way you’d interview a potential VP,” he advised.

Doerr has been at investing long enough to remember the first time technology rushed into the classroom—back in the late 1980s—and how it flopped.

“In the late 1980s, we [as an industry] were trying push tech into the classroom. We failed at that. Now 70 million kids [from grades school to grad school] are walking into classrooms with technology in their pockets,” he pointed out.

Doerr also has his eye—literally—on what he believes will be the next wave of technology: augmented reality. Technology seems to move in 15-year cycles, he mused. Personal computers, the web and browsers, and social-mobile have been previous “waves.” Each wave “is three times bigger than the ones that came before,” he contended. KPCB has put a whopping investment into augmented reality: In 2014, it joined Google and other investors by pumping $542 million into Magic Leap. (Yesterday, a raft of other investors, led by China’s Alibaba dumped another $793.5 million in the Dania Beach, FL company, valuing it like a quadruple unicorn.)

Even so, Doerr has had his share of stumbles, including the likes of Segway and even Kleiner’s tangle with a gender discrimination suit last year.

“Nothing ever goes according to plan,” Doerr reminded his audience.

The most important lesson learned by VCs overall last year, he said, was about “inclusion.”

“This will be a mission for a long time” for both companies and industry overall, Doerr said. “If you’re committed to this, you have to work at it.”

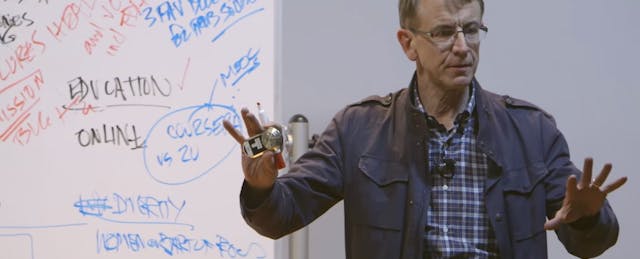

The above picture was taken during a March 2015 lecture by Doerr at UC Berkeley. See below.