It’s Fall in the U.S., and Fall brings change. Green leaves turn to red, shorts turn to pants, the baseball-playing Chicago Cubs turn to baseball-watching Chicago Cubs. Inevitable change.

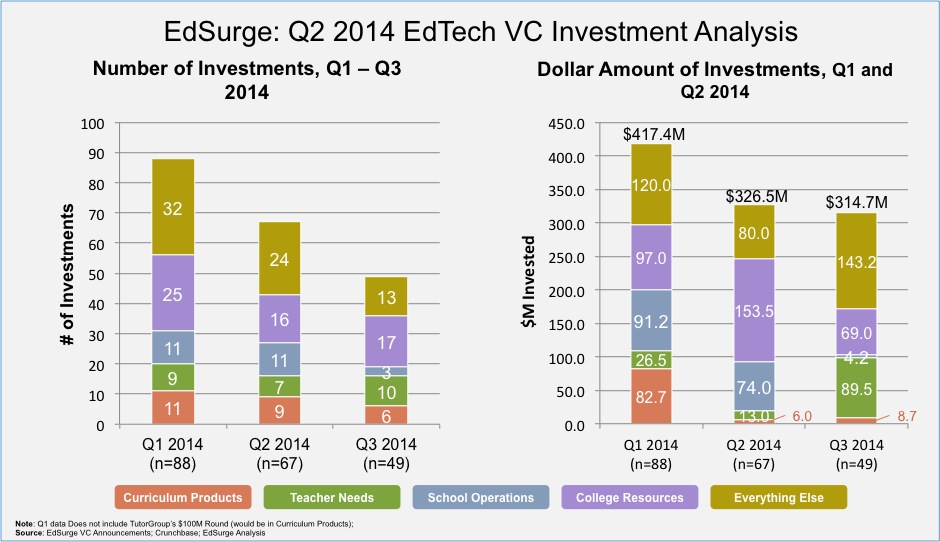

In Q3 2014, however, US edtech venture capital investment broke this trend and held steady at $315M according to analysis from EdSurge. This figure is down just slightly from the $327M reported in Q2 2014. Forty-nine separate deals were reported in Q3, down from 67 in Q2.

The post-secondary category lead the way in number of deals in Q3, with 17 out of the 49 reported (35%). A series of six deals for companies in the “MOOCs & courses” subcategory and as well as others in the “Persistance and Retention” and “College Prep” groups drove up this total.

Driving the total dollar figure in Q3 was the $135M Series B raise by Pluralsight in August. The Utah-based company was founded in 2004 and offers over 3,000 courses for professionals to learn new skills. Because products focused on training professionals are classified in the “Everything Else” category in our index, this group (in gold, above) took first place with 46% of the total Q3 funding. By itself, Pluralsight’s deal accounted for 43% of the total.

In second place with 28% of total funding was the Teacher Needs category. The $90M total in that category was driven by Remind’s $40M Series C raise and Edmodo’s $30M in Series D funding.

As in Q2, companies categorized as creating Curriculum Products continue to receive less funding than their percentage of overall deals might suggest. In Q3, Curriculum Products made up 12% of all deals (6 out of 49) but accounted for just 3% of funding ($9M).

Here’s the comparison in funding across the first three quarters of the year:

The number of School Operations deals fell to just three in Q3 (InjureFree, Schoolmint, and Ellevation) from 11 in Q2, while the total funding for that category dropped to $4M from its Q2 levels of $74M. Lead by the Remind and Edmodo deals, Teacher Needs investment jumped from $13M in Q2 to $90M.

Breaking down our broad categories into more specific groups, we found that Professional skills was the largest single sub-category (thanks again to Pluralsight). Other sub-categories winning big in Q3 included MOOCs & courses, and classroom efficiency.

As always, this analysis accounts only for VC funding, and ignores mergers and acquisitions. Thus, Microsoft’s $2.5 billion takeover of Minecraft-maker Mojang is not counted in this report. But if it were, the data for Q3 would look something like this.

What do you think about edtech funding in Q3? Let us know your thoughts in the comments section below, along with any questions or comments on the analysis. For more information on these, as well as ex-US deals, you can subscribe to our monthly Ka’Ching Reports.